The Impact Of Reddit Sentiments On Stock Market Prices

Reddit is the sixth most visited website in the United States. The site is extremely popular for memes, gossip, advice, and discussing niche interests. However, Reddit also plays a key role in the spread of misinformation and disinformation.

Reddit’s reputation as a meme engine and host to niche fan communities has created the perception that the social media platform is relatively innocuous. Yet, fake news spreads extremely easily on Reddit — and fake news has real-world repercussions. Dis- and misinformation caused stock market losses of $300 billion in a single incident.

As a result, it’s important to analyze consumer sentiment regularly on this platform.

How does Reddit impact stock market prediction?

No one can predict the stock market, but there are ways to have an impact on stock prices by influencing market sentiment. Reddit is a particularly effective channel for influencing stock market sentiment.

Perhaps the clearest example of how Reddit impacted stock market prices took place as recently as 2021. GameStop, a video game retailer, had become a popular bet among short sellers — investors who believed the stock would go down and were hoping to cash in on GameStop’s decline.

Discussion about GameStop had been ongoing on the Reddit channel r/WallStreetBets for awhile, but momentum started to gather when retail traders on the platform noticed how heavily shorted GameStop’s stock was. They realized that if they all acted together, they could sort of screw the shorts over and make a profit doing so.

As a result, GameStop’s stock price skyrocketed from under $20 at the start of 2021 to nearly $350 at market close on January 27. “An army of traders on the Reddit forum r/WallStreetBets helped drive a meteoric rise in GameStop’s stock price in recent days, forcing halts in trading and causing a major headache for the short sellers betting against it and banking on the stock falling,” reported Vox.

The GameStop event triggered more research into the impact of sentiment on Reddit. This research showed that GameStop wasn’t an isolated incident — sentiment on Reddit directly impacts the stock market.

Research from Arnav Machavarapu examined the impact of Reddit sentiment on the stock prices of GME and AMC Entertainment. Using sentiment data, Machavarapu’s study found that “if institutional investors had included sentiment data in their longitudinal models for predicting AMC and GME stock prices, they might have been able to avoid the short squeeze event.” Essentially, sentiment data alone can be predictive of stock prices.

Misinformation and disinformation on Reddit

This is an example of how Reddit can directly change the stock market, but there are other, less overt ways in which Reddit sentiment can change the generally accepted stock market prediction.

Misinformation and disinformation spread virtually unchecked on Reddit. The pandemic spawned dozens of subreddits claiming skepticism about COVID-19, questioning vaccines, and posting other disinformation about the virus. There were so many disinformation campaigns that the platform made the rare move to quarantine and outright remove some threats from the site.

Fake news also impacts the stock market. Fake stories or disinformation campaigns can impact market sentiment, defined as “a qualitative measure of the attitude and mood of investors to financial markets in general, and specific sectors or assets in particular.” Both positive and negative sentiments can drive price action, creating investment opportunities for traders and long-term investors.

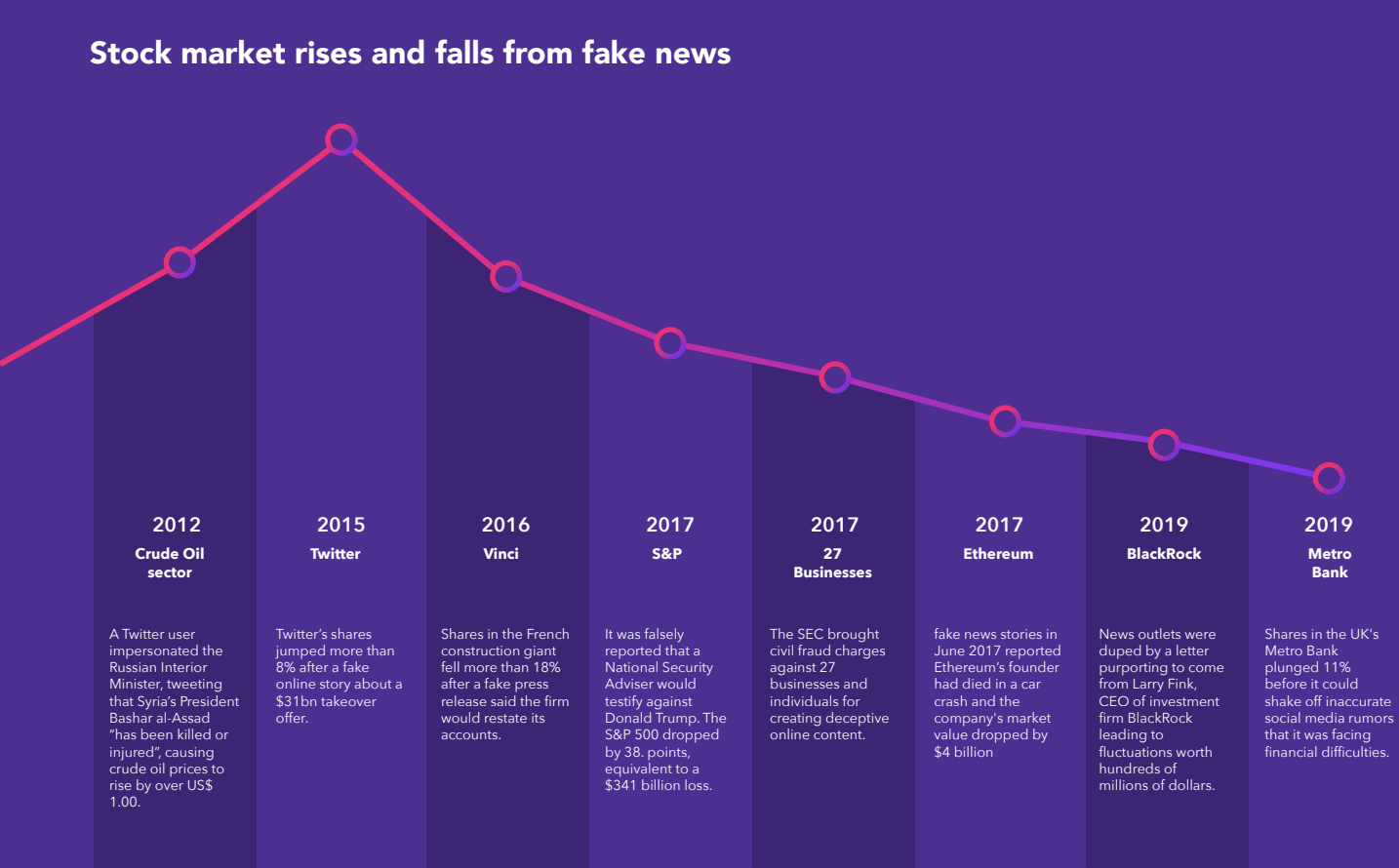

The chart below shows how fake news can directly impact the stock market by influencing market sentiment.

Just how correlated is fake news and market swings? It’s complicated. For short-term traders, the correlation is high. One study found that after fake news about small firms was published, the companies’ stock prices rose temporarily before falling again. “The deceptive articles often coincided with press releases and insider trading, suggesting that those firms tried to artificially inflate prices and sell their stock in a ‘pump and dump’ scheme,” wrote Yale Insights.

The trend holds less true for long-term investors, who pay less attention to the day-to-day news cycle when it comes to making investment decisions. Nevertheless, over time, fake news can erode trust in a company.

[Read more: What Is Brand Safety? (Definition, Examples, And Best Practices]

The importance of stock sentiment analysis

We know that fake news spreads fast on Reddit, impacting how users feel about brands, world events, and the economy. Likewise, sentiment on Reddit can have a direct impact on stock prices and the health of the overall stock market. How can we perform stock sentiment analysis in Reddit’s many communities?

Sentiment analysis involves collecting data and identifying patterns in the conversations of Reddit users (and other social media channels) — ideally, in real-time. Tools like PeakMetrics enable organizations to track millions of news sites and blogs, 5+ social platforms, podcasts, and TV/radio, automatically alerting you when your brand is mentioned.

PeakMetrics can scan Reddit to provide critical business insights — our machine learning platform detects online influence campaigns at scale and respond back when necessary. For those seeking to monitor the next GameStop scenario, PeakMetrics can flag discussions going on on Reddit that can potentially lead to the type of coordinated action that sends the stock market in a new direction.

Request a free report

Uncover emerging narratives around your brand, industry, and competition.

Sign up for our newsletter

Get the latest updates and publishings from the PeakMetrics investigations team.