Silicon Valley Bank: A Lesson in the Power of Online Narratives

On Friday morning, March 10, Silicon Valley Bank—long the preferred bank for many of the country’s biggest start-ups and tech companies—collapsed. It’s the second largest bank failure in U.S. history—and it all occurred over the period of just 48 hours.

So, how did it happen?

A Short Timeline and the Key Players

Silicon Valley Bank was created by two former Bank of America managers in 1983, and over the years, with the rise of the dot-com bubble, became the go-to lender for the tech community. By the time of its collapse, it was the 16th largest bank in the country.

As of 2022, the bank had $190 billion in assets. However, its investment in mortgage-backed security and long-term Treasury bonds led to a loss of $1.8 billion in 2023. Amidst these losses, on Wednesday, March 8, SVB made an announcement on how it planned to raise an additional $2.25 billion in capital. This announcement, poorly worded and timed, sent many depositors into a panic. They rushed to withdraw the money, and by Friday, the bank was forced to close.

As SVB was collapsing on Friday, broader panic spread throughout the tech and financial community. Customers of Signature Bank withdrew $10 billion in deposits on the same day SVB was crumbling, and by Sunday, Signature Bank became the third-largest bank failure in U.S. history.

The Social Media Effect

There’s been no shortage of analyses on why SVB, a once thriving financial institution collapsed within a matter of days. Many have focused on the initial losses at the bank, announced Wednesday; this was the result of a powerful combination of rising interest rates from the U.S. government, a floundering tech industry, and the bank’s sale of its bond portfolio. However, there was another key ingredient that paved the way for the bank’s downfall: panic.

Indeed, both Fortune and Business Insider ran stories declaring that SVB was the victim of the “first social media bank run.” As it is, Silicon Valley is a small community, and word travels fast between investors and entrepreneurs. Add in social media, and bad news can spread even faster.

On Wednesday, a day the tech community was already reeling following the announcement that crypto bank Silvergate. would close its doors, SVB announced its plans for raising several billion more in capital.

That little announcement was mentioned less than 10 times in online news on Wednesday, according to PeakMetrics. While a small number globally, it was being spread through the publications that matter for investors, such as MarketWatch Benzinga. The very next day, that number jumped to twenty. By Friday, it was 130.

It was also shared with customers, who were confused and panicked. Beginning March 9, one of the main narratives PeakMetrics tracked was “SVB financial stock plummets after (NASDAQ: SIVB).

And these investors can Tweet.

Following the news of SVB’s losses, on Thursday, Peter Thiel, a billionaire entrepreneur and venture capitalist with a devoted following, told his portfolio companies that they should pull their money out of SVB, igniting panic within the venture tech Twittersphere and arguably accelerating the bank run. And he wasn’t the only one. For example, popular financial expert Genevieve Roch-Decter tweeted, “Silicon Valley Bank $SIVB is in trouble. It sold off a $21 billion bond portfolio for a huge loss to shore up liquidity. The market is worried and the stock is down 54% today. Here’s what you should know.” Meanwhile, Kate Clark, Senior Reporter at The Information, tweeted about how VCs were advising founders to limit the amount of cash they were keeping in SVB.

Explore how Twitter conversations contributed to the snowball effect for SVB

Other trending tweets explained the panic and confusion among VCs occurring behind closed doors and urging calm.

As tweets began to build, word spread , as Fortune put it, through the “Tech Twitter” community, and customers rushed to pull out cash.

On Thursday, “SVB” was tweeted 9,864 times, and many of these tweets came from founders, entrpreneurs, and CEOs of tech companies. On March 10, the peak day of the bank run, SVB was tweeted a massive 162,854 times. Indeed, some of the most prominent narratives tracked by PeakMetrics surrounding SVB originated from social media, and, even as the bank run ended, some of the most shared mentions of SVB’s collapse came from Twitter.

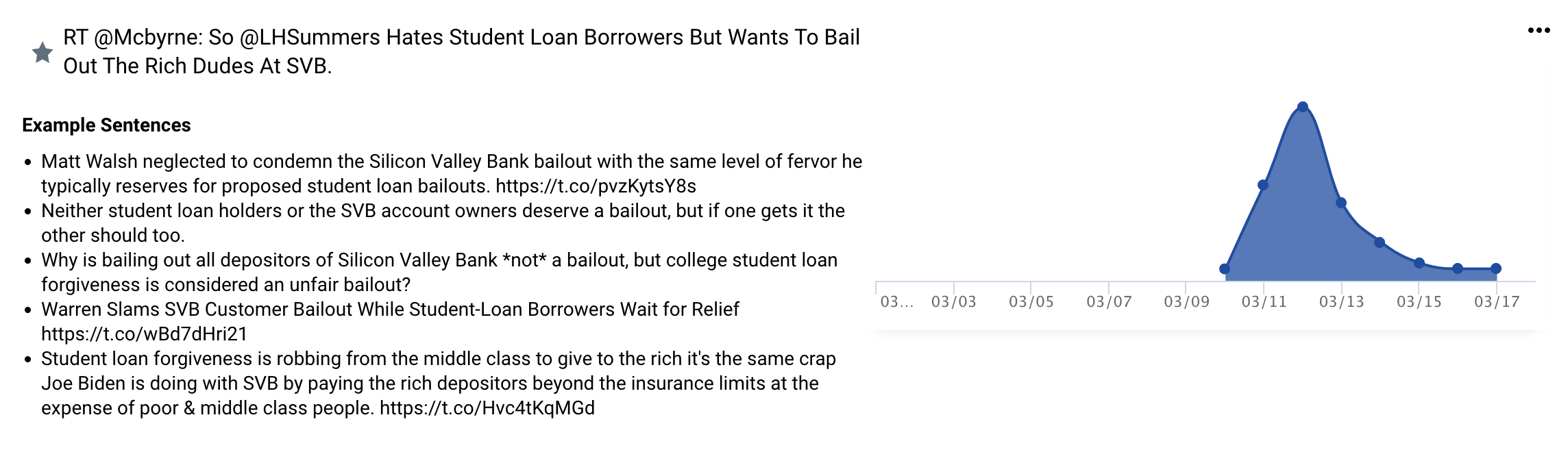

A Narrative that began to emerge that was automatically detected by PeakMetrics

Panic Spreads

On March 10, PeakMetrics tracked 371 media mentions involving “discussions and opinions on the collapse of Silicon Valley Bank.” That number jumped to 473 on March 11 and 556 on March 12. The numbers on Twitter were even more impressive. On March 11, SVB was tweeted 417,949 times. That number jumped to 475,866 on March 12.

Immediately following SVB’s collapse, other narratives began to emerge involving the broader financial community, such as “USDC should come out of this fine, but their slow public response to SVB exposure is causing panic.” Come Sunday, there was a second victim of this panic: Signature Bank. Now, some are starting to worry about banks like Fortuneo and Boursorama.

As of March 15, PeakMetrics is still tracking Tweets and Reddit posting links to articles or analyses that warn the crisis hasn’t been fully averted yet. PeakMetrics tracked 546,600 tweets of SVB on Monday, March 13 and 297,045 mentions on Tuesday, March 14.

While it does appear that Wall Street has calmed down, the internet has not.

Could Silicon Valley Bank have avoided the bank run?

TechCrunch’s article analyzing SVB’s collapse ran with the headline, “Silicon Valley Bank shoots self in foot”. Connie Loizos argued that had the bank not decided to release a convoluted press release about their convoluted plan to safeguard their business assets, then maybe none of this would have happened. Of course, there were financial risks inherent in the bank’s portfolio, and perhaps it would have failed eventually, but this announcement initiated the panic that ultimately led to the bank run.

One thing is certain: panic would not have spread as fast as it did without social media. Customers of the bank would not have been warned by their tech friends that they should pull their money, and Peter Thiel wouldn’t have been able to warn his companies to withdraw funds in public, in front of the entire Twitterverse. After all, obscure press releases don’t normally generate a lot of press coverage, and while the internet has created a 24/7 news cycle, it still takes time to publish an article. It takes a few seconds to create a Tweet.

The case of SVB is a case study in why narratives matter--and why companies need to be aware of what people are saying about them. Narratives have power. While SVB had its problems, it certainly wasn’t on the verge of collapse but because enough people believed it was, they created a self-fulfilling prophecy. Had SVB been paying attention to what people were saying about their losses or their proposed plan to shore up its assets, then maybe they could have reassured customers and investors. Maybe they could have intervened in time to avoid the mass hysteria that ensued.

Organizations should heed the lesson from SVB. News and social media monitoring are simply not optional anymore--they are essential. Not having a pulse on what’s being said about their businesses can have potentially disastrous consequences.

Sign up for our newsletter

Get the latest updates and publishings from the PeakMetrics investigations team.